Tsp withdrawal tax calculator

Does your plan suspend contributions for six months for hardship withdrawal. Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach.

Fers Retirement Calculator Youtube

You can use the calculator on tspgov to determine if you need joint life calculation.

. Well withhold 10 on the taxable portion of your withdrawal for federal income tax. Our Premium Calculator Includes. Multiply the portion of your distribution that isnt exempt from the early.

Taxes owed on 110000 at 22. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. There is a case where part of withdrawals from traditional TSP balances are not taxable for federal income tax purposes.

This Calculator Will Show You How Much You Might Earn Over The Lifetime Of Investing With Regular Contributions At A Given Rate Of. Our Resources Can Help You Decide Between Taxable Vs. For information about in-service withdrawal options visit the In-service withdrawals basics section of tspgov and download our updated booklet In-Service.

Ad Start Planning Your Financial Future With Our Digital Retirement Coach. This exception doesnt apply to a lot of people but it. For example if you.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. There are several options for withdrawals that avoid the 10 percent early-withdrawal tax penalty. Our Premium Calculator Includes.

If you arent able to take a qualified distribution when youre retired the earnings portion of the distribution is taxed and subject to the 10 percent early withdrawal penalty. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

You need to carefully plan your distributions from your TSP to supplement your retirement income gap so that you do not bump yourself. First you can wait until you qualify for age-based TSP withdrawals at. This information may help you analyze your financial needs.

It is based on information and. Multiply your taxable portion by the applicable federal state and local tax rates to calculate the income taxes on the distribution because it is treated as ordinary income. This information may help you analyze your financial needs.

Taxes Owed On 110000 At 22. Tsp Early Withdrawal Tax Calculator. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. For example if your.

Military Retirement Pay Calculator Military Onesource

Calculator Retirement Plan Withdrawal Milspouse Money Mission

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Tsp In Tax Season

Service Computation Date Differs Based On Usage

Calculators The Usaa Educational Foundation

Tailoring A Tsp Annuity

Tsp Waives Penalties For Coronavirus Related Early Withdrawals Joint Base San Antonio News

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Making Traditional Vs Roth Tsp Contributions Do You Know The Differences Between Traditional Contributions And Roth Tsp Contributions This Video Can Help You Understand What They Are By Thrift Savings

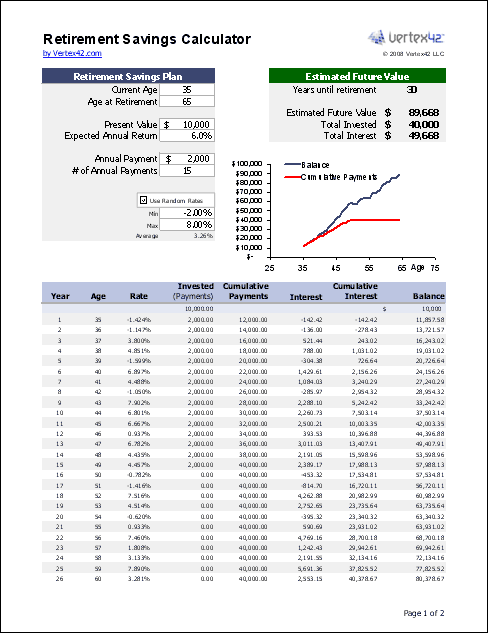

Retirement Withdrawal Calculator

401k Calculator Withdrawal Online 56 Off Www Ingeniovirtual Com

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Retirement Withdrawal Calculator For Excel

401k Calculator Withdrawal On Sale 53 Off Sportsregras Com