18+ Borrow on mortgage

Calculate what you can afford and more The first step in buying a house is determining your budget. The annual percentage rate APR on a 30-year fixed-rate mortgage is 565.

Loan Officer Job Description Expected Salary And What Your Day Will Look Like

With todays interest rate of.

. Ad Compare Mortgage Options Get Quotes. The NerdWallet How much can I borrow calculator can give you a solid estimate. For example if you earn 30000 a year you may be able to borrow anywhere between 120000.

You can calculate how much. Compare Quotes See What You Could Save. A down payment of 20 percent or more or in the case of a refi equity of 20 percent or more gets you off the.

Ad Shortening your term could save you money over the life of your loan. The calculator considers standard mortgage payment elements such as principal and interest. For this reason our calculator uses your.

Ad Find Mortgage Lenders Suitable for Your Budget. Compare Quotes Now from Top Lenders. This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow from a mortgage lender.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Mortgage calculator Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Search for a new home get connected with a local agent and shop for your next mortgage with Nuborrow.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Lenders will typically use an income multiple of 4-45 times salary per person. The APR was 547 last week.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. You borrow some money on a mortgage loan.

However some lenders allow the borrower to exceed 30 and some even allow 40. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. How Much Money Can I Borrow For A Mortgage.

A co-borrower is a person who applies for and shares liability of a loan with another borrower. The two examples above demonstrate how you could potentially increase your borrowing capacity 4x with some. When youre trying to take a loan against your mortgage borrow limits are.

The amount you can borrow on a second mortgage depends on the amount of equity youve built up in your home. As part of an. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

Borrowing less translates to a smaller monthly mortgage payment. 2000 plus 5 stars reviews 4361 home buyers applied last month. Your payments are 750 to start with on a loan with a 30-year amortization and monthly payments.

But ultimately its down to the individual lender to decide. Your maximum borrowing capacity is approximately AU1800000. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income. APR is the all-in cost of your loan. So if your home is worth 200k and your existing first.

Your rate is 4 per year. Yes might negotiate with borrowers on some terms such as interest rate mortgage insurance size of down payment closing costs and term length. This mortgage calculator will show how.

If you have an extremely low debt-to-income ratio you may be able to borrow as much as 89 percent. Under these circumstances both borrowers are responsible. A general rule is that these items should not exceed 28 of the borrowers gross income.

Get Your Best Interest Rate for Your Mortgage Loan. Find out how much you could borrow.

8 Lenders Like Big Picture Loans Compared Find Better Alternatives

23 Passive Income Apps That Give Make You Money 2022

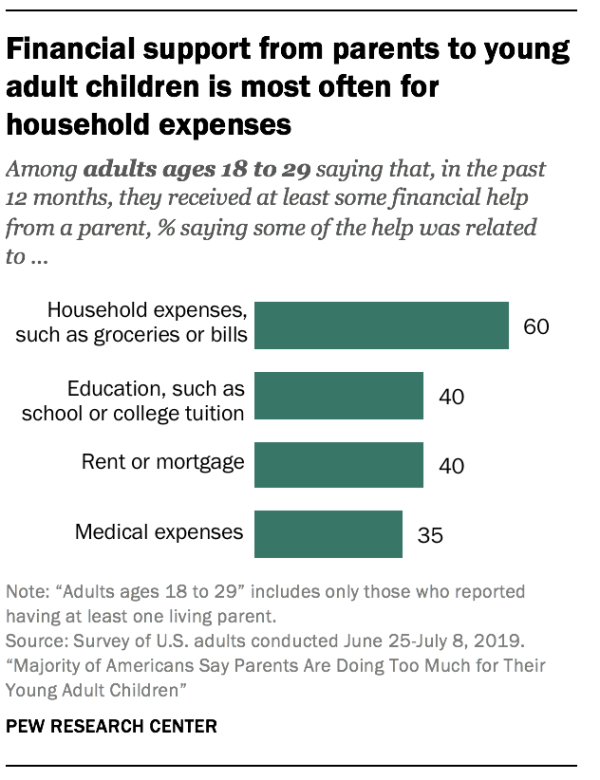

Only 24 Of Young Adults Are Financially Independent By 22 Per Pew

How To Build Your Credit At 18 Credit Sesame

How To Build Your Credit At 18 Credit Sesame

Csrwire Regions Next Step Survey Finds Americans Are Increasingly Prioritizing Renovations To Boost Home Value

When You Should Refinance Your Mortgage Listerhill Credit Union

Pin On Monthly Budget Template

How To Build Your Credit At 18 Credit Sesame

How To Build Your Credit At 18 Credit Sesame

Why Get Pre Approved For A Mortgage Loan Listerhill Credit Union

/mortgage-broker-3b0953175a7e4d90b99e937b79e0cd14.jpg)

Mortgage Brokers Advantages And Disadvantages

18 Sample Loan Receipts In Pdf Ms Word

18 Sample Loan Receipts In Pdf Ms Word

15 Online Loan Applications Personal Auto Home 2022 Badcredit Org

Regions Next Step Survey Finds Americans Are Increasingly Prioritizing Renovations To Boost Home Value

How To Build Your Credit At 18 Credit Sesame